Are you looking for a car title loan? Perhaps you want one but are looking to learn about the loan’s terms first before getting started.

On this page, we’ll share everything you need to know about car title loan calculators and how to use them.

What Is a Car Title Loan Calculator?

A car title loan calculator is an excellent financial tool that’s highly useful in determining the estimated value of a car title. It can offer you huge help if you’re in urgent need of cash but are unable to secure financing from traditional outlets like credit unions or banks.

Online car title loan calculators are fairly simple to use and will provide you with an estimate of how much getting a title may cost you. It can also give you an estimate of the total costs of future interest as well as your monthly payments, making it a comprehensive solution.

Having these details can help you to manage your expectations and your finances while guiding you toward the right decision regarding your car title loan. You can also use a car title loan whenever you need it, even if you’re not going to be applying for a title loan immediately.

Why Use a Car Title Loan Calculator?

A car title loan calculator can help to give you all the details you need to know before you actually apply for a title loan. Doing this step ahead of time is highly important and beneficial and can give you plenty of advantages, such as:

Free Service

A car title loan calculator provides quick and free services — all you have to do is fill out the necessary details and wait for the results. Because it’s 100% free to use, you can use it to experiment with different amounts to get the best estimate for your needs.

Easily Compare

Rather than working hard to make comparisons between the different offers given to you from various lenders, head straight to our car title loan calculator. Just enter your preferred terms and see which offers give you the best results.

Optimized Loan

Our quick and easy car title loan calculator is a great solution that provides you with the details you need while presenting the most optimal loan for you. If you have concerns about the loan, speak to us to help you make an informed decision.

Using a Car Title Loan Calculator

Many people agree that the best thing about using a car title loan calculator is how easy it is. With it, you can conveniently learn about the various financial options available to you before you even start a loan application.

But, before you use this tool, be sure to have the following details ready:

The Loan Amount

When entering the loan amount, you’ll need to think about how much money you might need for the span of your loan. It’s best if you only borrow the bare minimum or the highest necessary amount instead of the highest amount you can get.

This is because you can quickly collect interest rates that can multiply exponentially.

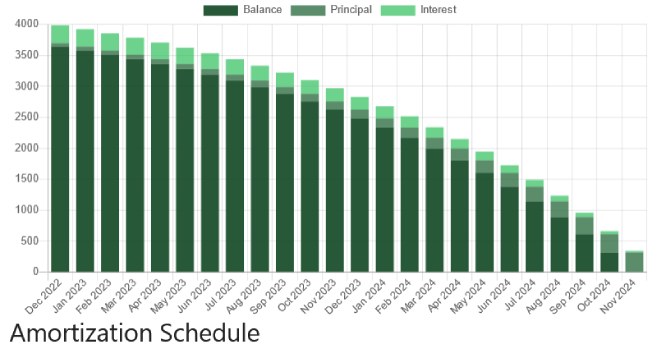

The Loan Term Months

To work out the amount of time you’ll need for the duration of your loan, be sure to plan ahead to see what will work well with your expenses and your income. Be sure to remember that most car title loans will last between 24 to 48 months, but there are other flexible options.

You’ll also see that making changes to the length of your loan will directly affect your monthly payments.

The Interest Rate

Here, you can check on the yearly interest rate and how it will affect your monthly payments as well as the entire interest you’ll be paying on the loan.

Remember that the result shown on your car title loan calculator is meant to assist you in making an informed decision for a loan. Because there are no limits to how many times you can use a car title loan calculator, you’re welcome to play around with the details to get a better sense of what kind of loan will work better for you.

You may also use these results you get to compare them with other rates and terms from other lenders or you can use them for learning to help you understand how these loans work.

Explaining Important Title Loan Calculator Terms

Before you use a calculator for your car title loan, be sure to understand some of the basic terms you need to know.

Loan Amount

This refers to the total amount of the loan and will include the fees that may go along with it. Most car title loans will have a $15 fee that’s charged through the DMV to add a lien on the title.

Many lenders will also charge you an administrative fee to cover the process of the loan.

Loan Term Months

This is pretty easy to understand and refers to how many months you want your loan to last — while it’s common for a car title loan to run for 24 to 48 months, it can vary by state and by company. Be sure that the lender you choose won’t charge a prepayment fee so you can pay off your loan in full at an earlier date without the need to pay extra.

Interest Rate

You may already know about interest rates but this can be a confusing term when it comes to a loan. Some companies will talk about monthly interests while others will talk about yearly interests, which is known as APR.

In general, the higher your interest, the more you’ll need to pay back for the money you borrowed.

Other Title Loan Calculators

-

Title Loanser

– Title Loanser is a title loan referral service that offers a great calculator page with tons of title loan information, tips and tutorials. Its not cost and free title loan calculations are helpful and best for when you’re still just searching.

-

5 Star Loans

– They rank high and the calculator is very easy on the eyes however, we are unsure of its accuracy

-

Cash Store

–

-

Montana Capital

–

-

800 Loan Mart

– Loan Mart is a direct lender in the USA and offers some great rates

-

Title Max

– Title Max is probably the most known and long time direct lender of title loans but they tend to be the most expensive. There are locations near you all over the nation.

-

Money Zap

–

-

Max Cash

– Max Cash is not a direct lender as we know it and aggregates some of the above lenders for you.

More Details on Car Title Loans

Everything we discussed above is what you need to understand before getting a car title loan. While it may sound overwhelming at first, you’ll be able to understand how car title loans work by experimenting with our quick and free calculator.

If you feel that you still need help with a few things, feel free to contact our loan agents through our website or call us.

The Car Title Calculator